While analyzing the health of a business or checking the return on investment, YTD comes out as a dependable measure.

You might be wondering, what does it mean?

YTD, which stands for year to date, is the comparison of a specific parameter, like income or investment, from the beginning of a year to the current date.

To understand it well, here we will comprehensively discuss the YTD meaning, types, how to calculate it, and how it is important for the employees and the firm as a whole.

What is YTD Meaning?

YTD or Year to date refers to measuring a financial parameter within a time frame starting from the beginning of the current calendar or fiscal year to the present date.

These parameters are typically used to analyze the performance of investments, manage business strategies, and report financial figures to assess the health of the business.

Some corporate groups use YTD more often than others. They are:

- Businessperson: Business owners use YTD data to monitor ongoing performance and ensure the business is on track toward its annual goals. It helps them make timely decisions for growth and adjustments.

- Financial planning: These teams rely on YTD figures to evaluate trends, forecast year-end results, and guide strategic financial planning. The data support budget management and resource allocation.

- HR Team: HR and payroll departments use YTD information to calculate cumulative employee earnings, benefits, and tax withholdings throughout the year. It ensures accurate payroll processing and compliance.

- Accounting Managers: The accounting professionals use this parameter to assess the performance of the firm at any point in time. It comes out as a dependable measure to analyze the company’s performance during unusual situations like mergers and acquisitions.

- Investors for Analyzing Investment Performance: Investors analyze YTD metrics to assess investment performance and company health within the current year. It aids decision-making regarding holding, buying, or selling assets.

FACT: APPLE’s fiscal year begins on the last Sunday of September. Interestingly, its fiscal year consists of 364 days, divided into 4 quarters.

After discussing the YTD meaning, the next thing that demands attention is how to calculate it.

Suggested Read: Imputed Income Explained: Meaning, Examples, and Tax Implications

How to Calculate YTD?

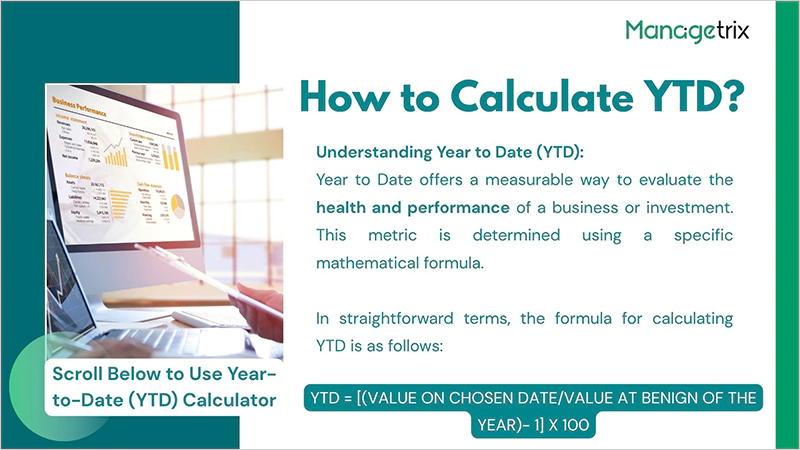

Year to Date provides a quantifiable measure for analyzing the health and performance of a business or an investment. It is calculated by following a mathematical expression.

In simple terms, the formula to calculate it is as follows:

YTD = [(Value on chosen date/Value at benign of the year)- 1] x 100

This provides the percentage figure that depicts the efficiency of the business. If the final figure is more than 1, your investment is up to the mark, and if it is less than 1, then it is a loss-making investment or asset.

To assist you in using this formula appropriately, here we have provided a step-by-step guide on calculating it.

- Identify your Reporting Year: Decide if you are tracking performance using the calendar year (say January 1) or a fiscal year (starting from a defined date).

- Determine the Start Date: Select the opening day of that chosen year as the reference point for your calculation.

- Select the Current Data Range: Now, pick the date you want to measure performance up to. This could be today’s date or any date before the year concludes (referring to your starting date).

- Find the Starting Value: Get the value of the investment or business metric at the beginning of the year.

- Find the Current Value: Note the value of the investment on the specified or current date.

- Apply the Fraction Step: Divide the current value of step 5 by the starting value of step 4.

- Subtract the Baseline: Take the result from step 6 and subtract 1 from it. This step is to isolate the growth factor.

- Convert to a Percentage: Multiply the outcome by 100 to get the result in percentage terms.

The above processes can be comprehensively understood through the following example.

Let’s assume a firm has the current holding of $1,60,000, and it had the holding of $1,00,000 at the beginning of the year.

So using the above formula, i.e.

YTD = [(Value on chosen date/Value at benign of the year)- 1] x 100

We can derive the YTD of the firm’s investment.

= [(1,60,000/1,00,000) – 1] x 100 = 160%

This means that for every dollar invested in the business, the investor gained 1.6 dollars.

It has been classified into certain categories based on the differential meaning of YTD. These types have been discussed holistically in the section below.

Year To Date Calculator

The above calculation is simple to perform, but requires accurate mathematical computation to derive precise decimal results.

If you want to make these calculations easier and quicker, we are providing you with a YTD calculator.

Year-to-Date (YTD) Calculator

Year-to-Date (YTD) Calculator

In this calculator, you need to put 2 inputs, i.e.,

- Starting Value: The value of your investment or asset at the beginning of the year.

- Value on Current Date: the current value of the asset or investment.

After putting in the desired values, click on “Calculate YTD,” and the calculator will provide an accurate year-to-date measure.

Major Types of YTD

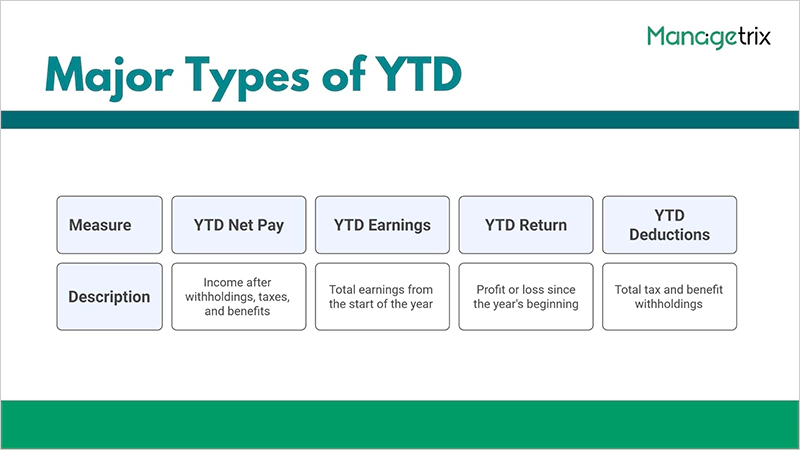

The year-to-date measure has been used by firms and employees to determine different parameters. This has led to its categorization as mentioned below.

- YTD Net Pay: The YTD Net Pay shows the difference between the income of the employee and his withholding, including the taxes and the benefits. It is generally mentioned on the salary slip of the employees.

- YTD Earnings: This parameter shows the earnings of the employee or the business from the beginning of the year, be it the calendar year or the fiscal year.

- YTD Return: It mentions the profit and loss earned by the employee since the 1st day of the year.

- YTD Deductions: The total amount of tax and the amount with reference to the other benefits withheld from the income of the employee.

The meaning of YTD is also concerned with the type of year we consider when calculating it, i.e., the calendar year or the fiscal year.

YTD Calendar Year vs. YTD Fiscal Year

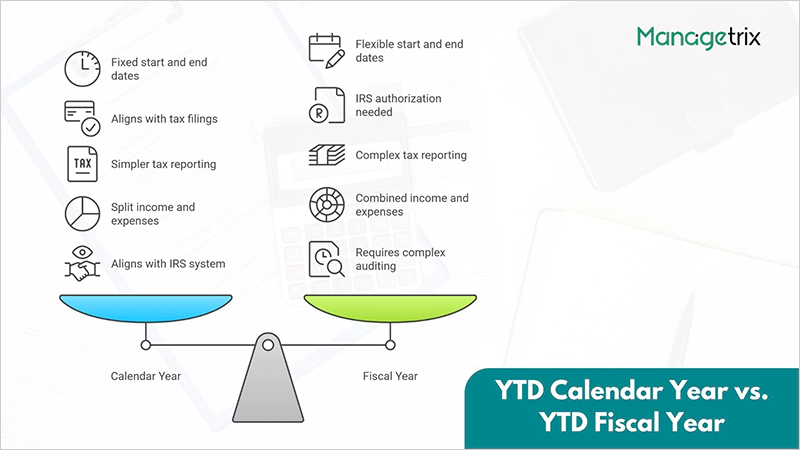

The YTD is calculated by considering two types of years: the calendar year and the fiscal year. Although they both span for 12 months (365 days), the fundamental difference between them is the beginning and end dates of the period.

Firstly, let’s understand their definitions.

- Calendar Year to Date: This type considers the calendar year to calculate the YTD. Here, the year starts with the 1st of January and ends on the 31st of December of the respective year.

- Fiscal Year to Date: This type is concerned with the fiscal year, i.e., the beginning and end dates align with the fiscal year, which may vary from 1st January to 31st December.

Besides the above-mentioned difference, they also vary in certain other perspectives, which are mentioned in the table below:

| S. No. | Difference | Calendar Year | Fiscal Year |

| 1 | Starting and end dates | 1st January to 31st December | 12-month period (365 days) |

| 2 | Alignment with tax filings | Same reporting period | Specially authorized by the IRS (Internal Revenue Service) |

| 3 | Who uses it | Individuals, small and medium businesses | Government entities, large businesses, and nonprofit organizations. |

| 4 | Simplicity in reporting taxes | Greater simplicity in tax reporting | Lesser simplicity in tax reporting. |

| 5 | Impact on income and expenses | Split income and expenses into two | Keeps income and expense records together |

| 6 | Relevance | Aligns with the IRS’s system | Requires complex auditing and accounting procedures. |

| 7 | Example | Apple |

Typically, the calendar year is considered for most purposes, but the fiscal year is opted for by the business and governmental organizations to align it with the annual budgetary provisions.

Other Time-based Parameters like YTD

Similar to YTD, the provisions of MTD, QTD, and YoY are also prevalent among the business owners and the investors’ fraternity. Here are the other 3 most used time-based parameters by businesses.

- MTD: The MTD means month to date, i.e., the period starting from the beginning of the month to the current date

- QTD: QTD means quarter to date, which is similar to YTD, as it considers the beginning of the quarter.

- YOY: Year over Year compares the specific time span of the year with that of the previous year. For example, the performance of the business from January to March this year vs. its performance between January to March last year.

The YTD meaning, features, and types correspond to certain benefits that must be pointed out in the discussion.

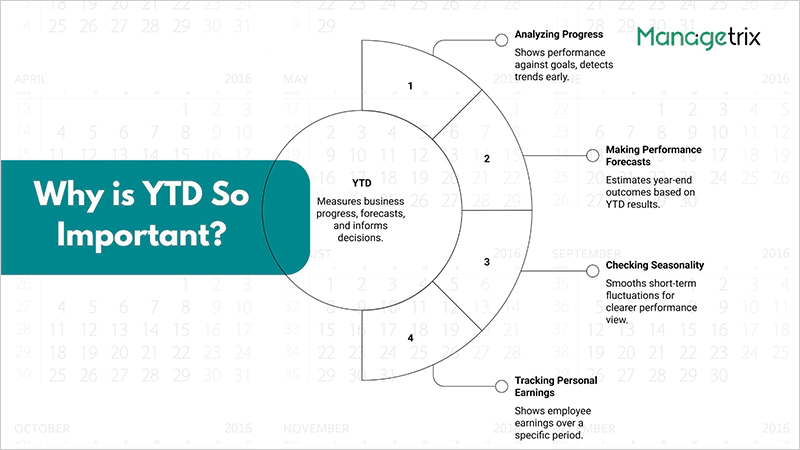

Why is YTD So Important?

YTD is important to measure the progress of the business, make financial forecasts, and make informed decisions. This makes it highly significant in the corporate sector.

Here are some of its inevitable benefits that you must be aware of.

- Analyzing Progress: YTD reporting shows how the business is performing against its annual goals. It allows for early trend detection and timely strategy adjustments.

- Making Performance Forecasts: By using YTD results, businesses can estimate their likely year-end outcomes. Though basic, this approach helps anticipate if goals are on track, assuming steady progress.

- Checking Seasonality: As YTD data covers more of the year, it smooths out short-term rises and falls. This gives a clearer picture of overall performance beyond temporary seasonal fluctuations.

- Tracking Personal Earnings: The YTD earnings of employees show the amount earned by them in a specific period of time.

Conclusion

YTD meaning is Year to Date, which clearly signifies that it is a multifunctional performance measurement index used by firms and organizations to assess their performance over a period of time. Its types and related parameters help in gauging the business’s health more holistically. Besides, our YTD calculator provided above will help you in deriving the accurate results of your year-to-date figures.

Next Read: How Many Pay Periods in a Year? 2025 Employee’s Guide

FAQs

1. What does YTD mean on paycheck?

Ans: YTD on paycheck means Year to date, which is a total of the employee’s income and deductions from the beginning of the year to the date of issuing the paycheck.

2. What are MTD and YTD?

Ans: MTD and YTD mean month-to-date and year-to-date. They are a measure to check the health of your investment or business.

3. Can YTD be negative?

Ans: Yes, YTD can be negative if the current earnings or asset value have dropped since the beginning of the year.

4. What is YTD return??

Ans: YTD return signifies the profit and loss made by the assets from the beginning of the year to the current date.